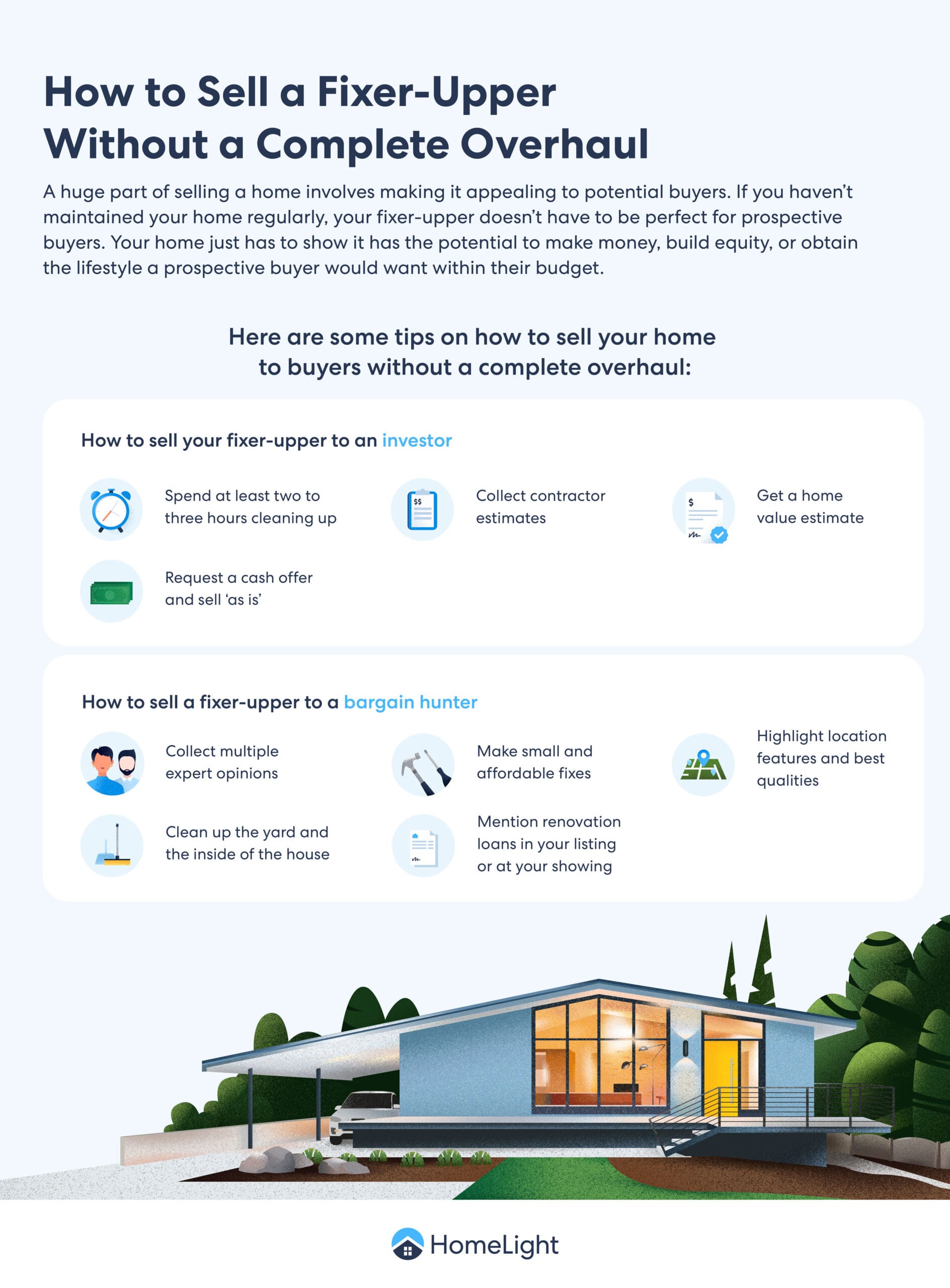

How to sell a house that needs work to an investor

Because price drives the investor, you don’t have to stress about looking through paint or flooring swatches. However, you should still prepare the house so it’s presentable, especially for your peace of mind.

1. Spend a few hours cleaning up

When you sell your home to an investor, you skip the process of staging and showing your home. However, an investor is still likely to perform a digital or in-person walkthrough of the property. The investor may arrange to stop by or send a representative of their business to perform an assessment.

Do what you can to make this a good experience. Clean dirty dishes, run the vacuum, and make the beds. Clear countertops and use a multi-purpose cleaner to scrub the bathrooms. Even when you sell as-is, a little sprucing up never hurts.

Arrange for a dumpster if you have a ton of junk. Close says in his area, most sellers don’t realize that they can rent a dumpster for about $300 for a week, including a company’s drop-off and removal fees, which can expedite the process.

Along with your home’s looks, focus on its smell. “We always walk the property and do a smell test,” says Joseph, whose office has cleaners ready to help before listing. “If the smell is off, most of the time, that’s a deterrent. That might cause someone to not even buy the house.”

2. Get a home value estimate

Do a little research on your home’s value before you accept an offer from an investor. You can start with a free estimate from HomeLight’s Home Value Estimator.

Our Home Value Estimator combs public data, including tax records and assessments, and pulls recent sales records for other properties in your neighborhood. Using a short questionnaire, we also factor in specifics about your home, such as the property type and described condition.

Simply input your address, and we’ll provide you with a preliminary home value estimate in less than two minutes. Although it’s not a substitute for a real estate agent’s comparative market analysis (CMA), an online estimate can provide a benchmark for determining whether any offers you receive are on the high or low side.

3. Collect contractor estimates

Joseph collects estimates from a team of contractors, plumbers, and builders to help set and negotiate a price. An investor himself, he appreciates having numbers handy, even for low-cost projects such as painting, to make the calculations easier.

An investor who has contractors on staff might pay less for repairs and renovations than someone hiring contractors a bit at a time, Close adds. However, he finds that having estimates available helps sellers gain a fuller picture of their property’s condition when he’s ready to negotiate.

“Some people just see the house as, ‘Oh, it’s cosmetics. It’s 10 to 15 years old. It’s dated.’ You can look at that house, and you can look at a house that’s in massive disrepair. But the costs could be similar to repair both,” Close says.

“If the house is dated, you still have to redo everything: the whole kitchen, the countertops, the cabinets, the flooring, paint the walls, remove wallpaper,” he explains. “If the house is in disrepair, you’re still going to have to do all those things.”

“The only real difference is the mechanicals,” he adds. “Is it in such bad repair that you have to replace and redo the electric, the HVAC, and all that? A house can look awful, and a house can look dated, but you’re probably looking at the same rehab costs.”

4. Request a cash offer and sell as-is

Now that you have an estimate of your home’s value and an idea of what repairs might cost, you’re ready to see what an investor would pay.

Consider requesting a no-obligation cash offer through HomeLight Simple Sale. We’ll connect you to the largest network of cash buyers in the U.S. to get you a competitive offer for your house within 24 hours. Home sellers can close in as little as 7 days and aren’t on the hook for any repairs, closing costs, or agent commissions.

“I think the big advantage for the seller with a cash offer is the convenience factor,” says Close, who works with Simple Sale sellers. “You close in as little as two weeks; there won’t be an inspection, just me walking through.”

“I get some houses where someone has lived there for a long time, and the house is in good shape. I also see homes with major disrepairs where someone hasn’t lived there in five years or kept up with it. It’s a pretty big variety,” Close adds.

How to sell a fixer-upper to a bargain hunter

Your fixer-upper could be the perfect home for a buyer who seeks a clean slate and the chance to design a home they haven’t been able to find or buy for the right price, especially in a coveted area. “The competition can work in your favor,” says Katrina Deist-Zemar, a top real estate agent in Mesa, Arizona, with 35 years of experience.

“People are waiting months for a house to come up in a [specific] subdivision,” she says. “To be able to get out of that box where everybody is waiting for a listing to pop is to be able to drive your own destiny.”

For these buyers, you’ll want to convey the potential they’re gaining while they’re saving on price (also while maximizing how much you can net, of course).

1. Collect expert opinions

Time to bring in the pros. Consider making these hires as you embark on selling your home.

Real estate agent

If you’re overwhelmed by the prospect of selling a fixer-upper, enlist the help of a top real estate agent who routinely sells homes that need some work. HomeLight makes it easy to find an agent with relevant experience through our agent-matching platform, and we’d be happy to make an introduction for you.

To determine home value, your real estate agent will conduct a comparative market analysis (CMA) that analyzes local comparable sales or “comps.”

Comps are homes similar in size, amenities, structure, and age to your own that recently sold in your area. Real estate professionals and home appraisers use comps as a reference point for the subject home and then make dollar adjustments based on competitive differences.

An agent’s pricing expertise will be an invaluable tool in selling your fixer-upper.

Home inspector

An inspector can also be your friend, even if you’re a little worried about what the inspection would uncover. Better to go in eyes-wide-open as to what issues may trip up your sale. You can opt to get a pre-listing inspection to identify any significant problems that might limit your buyer pool, such as repairs that might prohibit buyers with FHA loans from purchasing.

An inspection costs about $300-$500 on average but can save you time and headaches down the line.

While you might not be able to handle every repair financially, talk with your agent about necessary disclosures and how to bridge negotiation gaps with add-ins such as a home warranty.

2. Clean up the yard and the house

Take the time to clean your home to grab a buyer’s attention and get your highest price. A deep clean can add to the resale value, thanks to the good impression a sparkling home makes.

“Clean sells extremely well,” Deist-Zemar says.

Your home should look presentable in listing photographs, considering 43% of homebuyers begin their search online. “Even on my full-gutted properties, I still have a professional photographer,” Close says. “You have to take great pictures.”

And don’t forget about boosting your home’s curb appeal. Another HomeLight survey found that buyers will pay 7% more on average for a home with exceptional curb appeal. You don’t have to spend a ton, but consider removing weeds, mowing the grass, planting flowers in pots, and spreading fresh mulch to spruce up your landscaping.

If your front yard is mostly dirt, consider using gravel to improve your outdoor space. Laying down pea gravel costs about $170 to $560, making it a cost-effective way to improve the look of your outdoor space while improving drainage.

3. Make small and affordable fixes

Deist-Zemar recommends that sellers put in the time and effort it takes to prepare their homes for sale. “It’s definitely worth the seller’s time and money to make the smaller [updates] if they can.”

“I’ve always told my clients that it takes a buyer twice as much money to make the same repairs the seller could make,” Deist-Zemar says.

Think of it this way: The less you repair, the more equity you might have to give away in order to make the house worth it. Small repairs include but aren’t limited to:

- Adding some landscaping

- Patching nail holes in drywall

- Deep cleaning stained tubs and toilets

- Fixing broken or squeaky hinges and doors

- Fixing leaky pipes

- Adding new caulk around the tub and sink

- Cleaning grout

- Replacing cabinet knobs or handles

- Treating stains in your carpet

Joseph says if he notices FHA issues, such as paint, he’ll recommend that the seller address these before listing. “Paint goes a long way. Paint can make anything look brand-new. Some people love a fresh coat of paint, and that smell — it feels new.”